In relation to land and property rights in Malaysia, our country adopts the Torrens System, where registration is its cornerstone. S340(1) of the National Land Code provides that “the title or interest of any person or body for the time being registered as proprietor of any land, or in whose name any lease, charge or easement is for the time being registered, shall, subject to the following provisions of this section, be indefeasible.” The meaning of indefeasible was defined by the Privy Council in Frazer v Walker & Ors [1967] 1 AC 569 FC to be “immunity from attack by the adverse claim to the property or interest in respect of which he is registered, which a registered proprietor enjoys.” In short, the party whose favour the registration is made will obtain an indefeasible title or interest in the land, that is, a title or interest which is free of all challenges. This principle is known as the indefeasibility of title.

The principle of indefeasibility of title allows the purchaser to rely solely on title registration during real property transactions, which essentially eases the conveyancing process. This is known as the ‘curtain’ principle where the purchaser need not go behind the curtain to ensure the genuine proprietor of the land. Besides, this also reflects the ‘mirror’ principle where a person would only be bound by the encumbrances that were recorded upon the register.

As per Gibbs v. Al Messer [1891] AC 248, Lord Watson said:

The object is to save persons dealing with registered proprietors from the trouble and expense of going behind the register, in order to investigate the history of their author’s title, and to satisfy themselves of its validity.

However, exceptions to this principle is found in S340(2) of the National Land Code, which states that the title or interest of any person or body can be rendered defeasible and set aside by a body or person who has locus stand to take an action to set it aside if any of the vitiating circumstances under S340(2) apply.

The Section provides:

- in any case of fraud or misrepresentation, the registered owner of the title or interest will not enjoy indefeasible title if he or his agent was a party;

- any registration obtained by forgery or by means of a void instrument will not enjoy indefeasibility;

- the registered title or interest of a person or body can be set aside if it was unlawfully acquired by the person or body in the purported exercise of any power or authority conferred by any written law.

S340(3) further extends the exception to any subsequent transferee of such title or interest and any interest subsequently granted thereout.

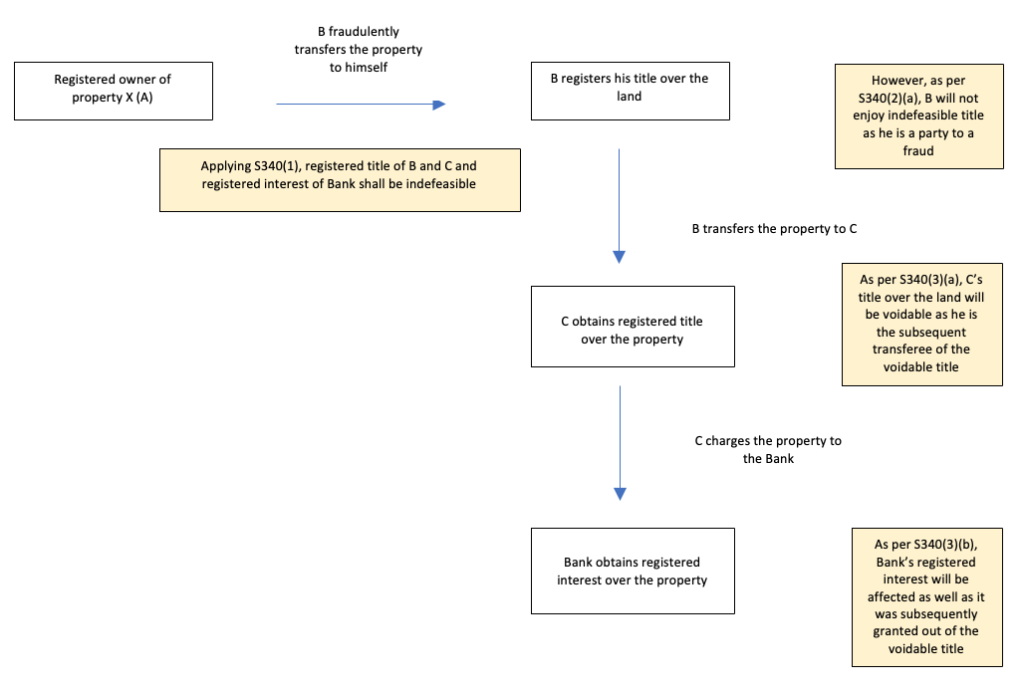

Example 1:

- A is the original registered proprietor of land X

- B fraudulently transfers land X to himself and obtains a registered title over the land.

- B further transfers the land to C and C registers the title.

- C charges land X to a Bank and the Bank’s interest was registered.

- The registered title of B will be rendered defeasible under S340(2)(a); the registered title of C will be rendered defeasible under S340(3)(a); the registered interest of the Bank will be rendered defeasible under S340(3)(b)

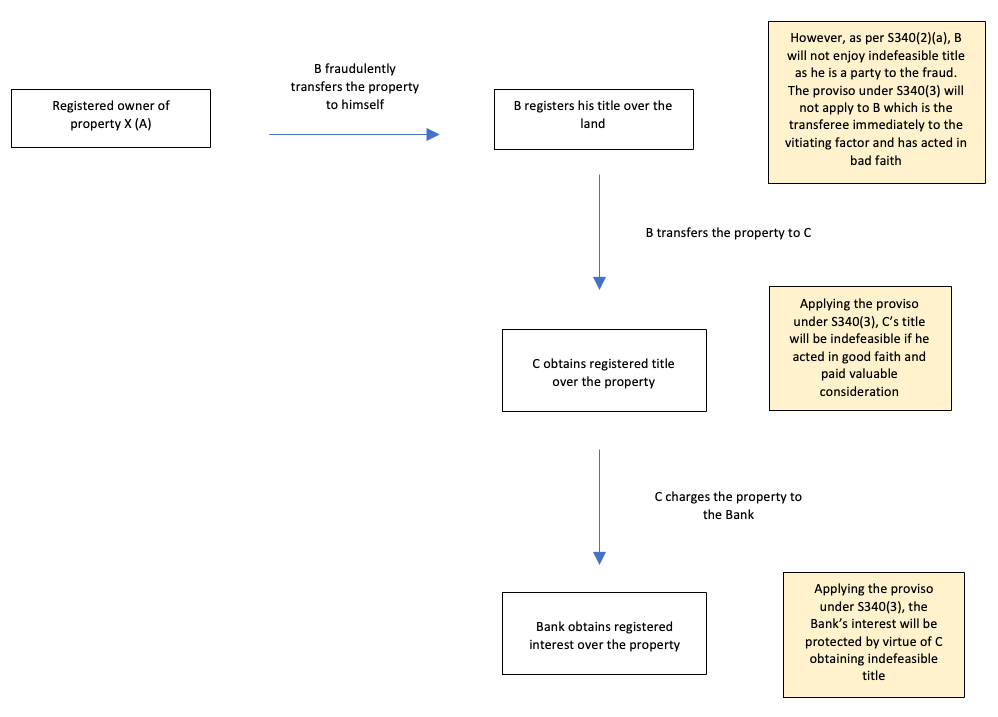

Complications arose in the interpretation and application of the proviso in S340(3), the registered purchaser of the title or interest over property will be protected if he acquired the title or interest in good faith and for valuable consideration.

Prior to the case of Adorna Properties v Boonsom Boonyanit [2001] 2 CLJ 133 FC, the prevailing view was that the provision under S340(3) confers deferred indefeasibility, i.e., only a subsequent bona fide purchaser for value of the registered title or interest over a land that was affected by fraud or forgery may be protected by indefeasible principle. This position was confirmed by the Federal Court in the case of Mohammad Bin Buyong v Pemungut Hasil Tanah Gombak [1981] 1 LNS 114 FC. In other words, the proviso only applied to the circumstances in S340(3).

Thus, applying Example 1, B will not be protected by the proviso under S340(3) but C and the Bank may be protected if they act in good faith and pay valuable consideration for the interest.

The implications of Adorna Properties and the cases that came after it are discussed in Indefeasibility of Title Part 2.